All you need to know about FASTag. FASTag is an electronic toll collection system that is based on radio frequency identification (RFID) technology and is used for collecting toll charges on highways automatically, FASTag Agent registration was launched by the National Highways Authority of India (NHAI) in 2014 to facilitate the collection of toll charges electronically and reduce congestion at toll plazas.

Welcome to sionline, your trusted FASTag service provider India. We are a leading FASTag Supplier in India dedicated to simplifying toll payments and improving your overall travel experience through our reliable and convenient ecosystem.

At sionline, we offer a range of FASTag services, including account creation, tag issuance, recharge, and customer support, among others. Our aim is to provide you with a seamless and hassle-free experience, whether you are a regular commuter or a first-time user of FASTag.

Our team is always ready to assist you with any questions or concerns you may have, and we maintain the highest standards of customer satisfaction and service quality. Sionline is one of the best FASTag agency providers in India.

As an authorized FASTag service provider, we adhere to the guidelines and standards set by the National Payments Corporation of India (NPCI) and the Indian government, ensuring that you can trust us with your toll payments and personal information.

We also partner with India’s leading IDFC First Bank to offer you a range of secure and convenient payment options, giving you the flexibility to manage your FASTag account the way you prefer.

SiOnline is The By Far the Best FASTag agency provide in India. We provide FASTag Dealership & FASTag Distributorship. You can always rely on Sionline for your FASTag needs. We look forward to partnering with you and making your FASTag experience seamless.

To Become a FASTag agent To Get a FASTag franchise, Sign Up for a FASTag Agent ID or to start a FASTag business you need an agency that is authorized by the issuer bank IDFC First Bank., SiOnline Technomart is authorized Business correspondent of IDFC First Bank to appoint Fastag agents in india. We are Trusted FASTag Authorized Channel Partner of IDFC First Bank.

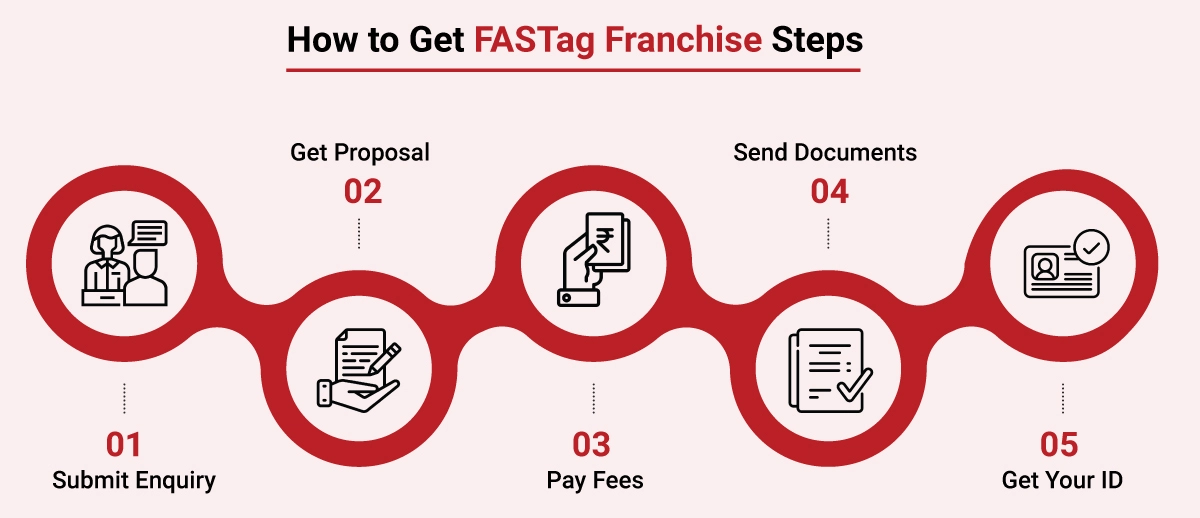

Here are the some general steps to apply for a FASTag franchise or FASTag business:

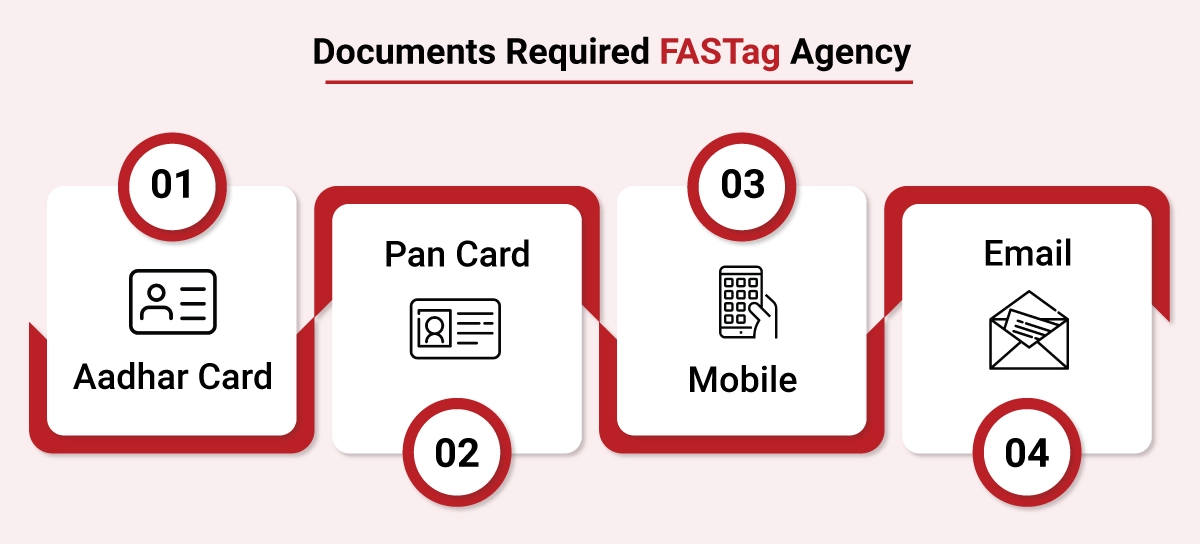

FASTag is an RFID tag that is affixed to the windscreen of a vehicle and communicates with the toll plaza infrastructure using RFID technology. The tag contains a unique identification number, bank and issuer logo, barcode, and QR code for identification and verification purposes. In India, we provide FASTag Agent registration. Your PAN card, Aadhaar card, business FASTag registration certificate, and bank statement may be requested as supporting documentation. As a FASTag agency, we can streamline the franchise registration process and provide a smooth onboarding procedure.Your financial institution statement, PAN card, Aadhaar card, business FASTag registration certificate, along with other documents may be requested as additional proof of identity. We follow the criteria and standards established by the National Payments Corporation of India as an authorised FASTag service provider. When a vehicle passes through a toll plaza, the tag is detected by the reader, and the toll amount is automatically deducted from the user's prepaid account associated with the particular tag.

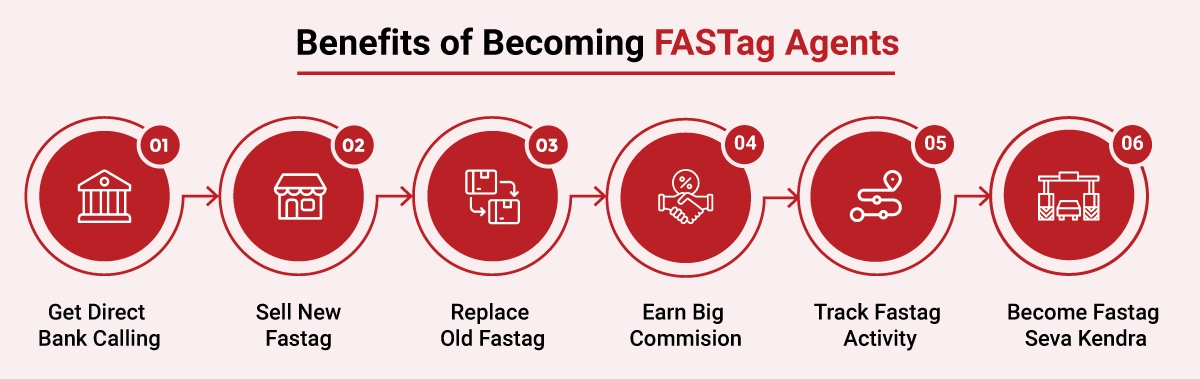

The commission you can earn as a FASTag agent varies depending on the issuer bank or agency. Usually, Agent gets commision on issuing a new fastag and when recharge or topup is done on the fastag. Your PAN card, Aadhaar card, business FASTag registration certificate, and bank statement are just a few examples of the documents that may be needed. Agents get a very high commision of Upto Rs.125 per FASTag issued. The commission on recharge or topup ranges from 0.25% to 1% of the transaction amount.

In addition to the FASTag agent commission, some banks or agencies may also offer other incentives and bonuses to their agents based on their performance. These could include volume-based incentives or rewards for meeting targets.

It is important to check with the FASTag issuer bank or agency for their commission structure and other incentives before applying to become a FASTag agent. You will receive a FASTag agent commission as a FASTag franchisee or FASTag seva kendra on each sale or FASTag account recharge.

| Vehicle Description | Tag Class |

|---|---|

| Car/Jeep/Van/Mini Light Commercial Vehicle | 4 |

| Light Commercial Vehicle | 5 |

| Bus/Truck (3 axle) | 6 |

| Bus/Truck (2 axle) | 7 |

| Truck (4 to 6 axle)/Tractor/Tractor with Trailer | 12 |

FASTag vehicle classification is based on the number of axles a vehicle has. The toll charges for each vehicle type are calculated based on the number of axles and the distance traveled on the toll road.

The toll charges for each category of vehicle are different, with Category 1 vehicles being charged the lowest and Category 6 vehicles being charged the highest. We abide by the rules and criteria established by the National Payments Corporation of India as a licenced FASTag service provider. It is important to ensure that the correct vehicle category is selected while purchasing a FASTag and while passing through a toll plaza to avoid incorrect toll charges.

FASTag fees and charges vary depending on the issuing bank or agency. Some of the common fees and charges associated with FASTag are:

It is important to check the fees and charges associated with your FASTag issuer before applying for a FASTag or recharging your account.

| Particulars | Amt (INR) |

|---|---|

| FASTag Joining Fee | Rs 100 (Inclusive of GST) |

| FASTag Replacement Fee | Rs 100 (Inclusive of GST) |

The commission you can earn as a FASTag Agent registration varies depending on the issuer bank or agency. Usually, Agent gets commision on issuing a new fastag and when recharge or topup is done on the fastag. Agents get a very high commision of Upto Rs.125 per FASTag issued. The commission on recharge or topup ranges from 0.25% to 1% of the transaction amount.

In addition to the transaction commission, some banks or agencies may also offer other incentives and bonuses to their agents based on their performance. These could include volume-based incentives or rewards for meeting targets.

It is important to check with the FASTag issuer bank or agency for their FASTag agent commission structure and other incentives before applying to become a FASTag agent.

FASTags are issued by banks and IDFC First Bank is one of them. Fastag can be linked to the user's account, such as a savings account or an e-wallet, for automatic payment of toll charges. The user can create a prepaid account through IDFC First Bank in India. The user can link their FASTag to their existing bank account, or they can create a separate wallet account for it. FASTag Agent registration is something we provide in India. We can streamline your franchise registration procedure and provide a smooth onboarding process as a FASTag agency.

The prepaid account linked to the FASTag can be recharged using various payment modes, including debit card, credit card, wallet apps, net banking, and UPI. The user can also check their account balance and transaction history through the IDFC Bank app or by logging into their bank account. Additionally, the option of setting up automatic recharge for the FASTag account when the balance falls below a certain threshold can be done.

The specific documents required to create a FASTag Agent ID for a FASTag agency partnership may depend on the bank or agency you are applying to for FASTag Dealership. Here is a list of common documents that must be required:

It is always recommended to check with the specific bank or agency (FASTag seva kendra) you are applying to for a complete list of required documents. We follow the rules and specifications established by the National Payments Corporation of India as an accredited FASTag service provider. You may also need to fulfill some eligibility criteria such as having a minimum net worth, experience in the banking or financial sector, and other requirements as per the bank or agency's policies.

Below are the steps to apply for FASTag and you need to follow these Activation Process:

It is always recommended to check with the specific bank or agency (FASTag seva kendra) you are applying to for a complete list of required documents. A copy of your business's IRCTC agent registration form may be required if you are a registered business entity. You may also need to fulfill some eligibility criteria such as having a minimum net worth, experience in the banking or financial sector, and other requirements as per the bank or agency's policies.

Follow the steps below to recharge your FASTag account:

Note: The process of recharging a FASTag account may vary slightly depending on the issuer bank or the payment mode selected by the user. However, the basic steps remain the same., Alternatively you can also recharge your IDFC First Bank Fastag through Prepaid Wallets like PayTM, Gpay, Phonepe, ETC

There is no difference in terms of types of FASTag as all the FASTags are based on the same technology and operate in the same way. However, there are multiple banks and agencies that provide FASTags in India. These banks may differ in their fee structure, recharge options, customer support, and additional features offered with the FASTag.

It is important to note that all FASTags can be used on any toll plaza across India. It is recommended to compare the features and benefits offered by different issuer banks before applying for your FASTag.

To login to the FASTag agent ID, follow the steps below:

FASTag offers several benefits to users, toll operators, and the government. Here are some of them: